In conversation about TNFD adoption

By Dr Hannah Rudman, Director of Development and Policy & Helen Avery, Non-executive Director at Highlands Rewilding, and Director of Nature Programmes and GFI Hive.

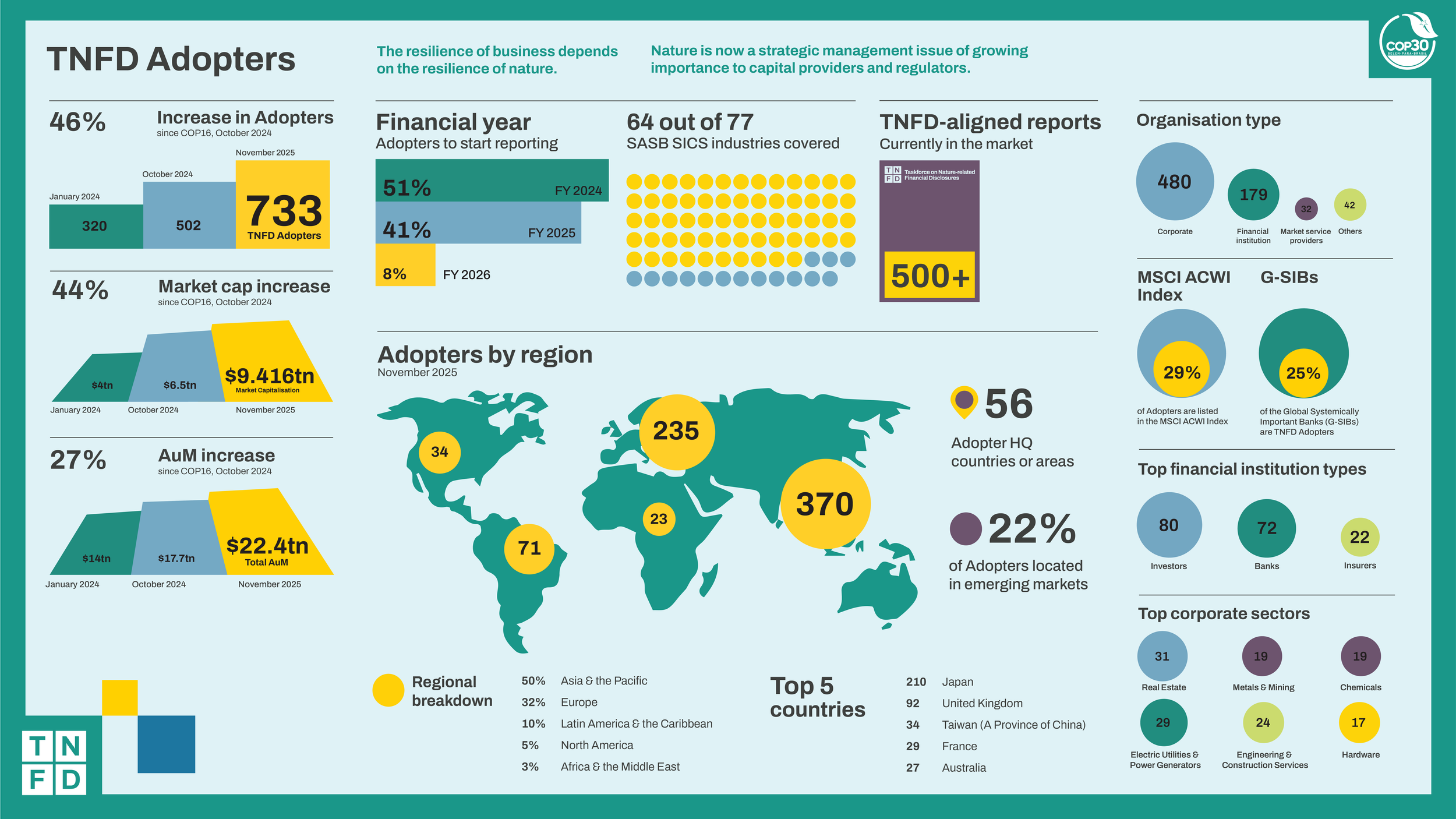

As of November 2025, the TNFD has 733 early adopters – and Highlands Rewilding is delighted to be a part of this growing global momentum. Announced at COP30 in November, we are one of only two Scottish organisations to be adopters, the other is Aberdeen Group plc, headquartered in Edinburgh!

TNFD stands for Taskforce on Nature-related Financial Disclosures, and the TNFD framework helps organisations identify, manage, and disclose their nature-related dependencies, impacts, risks, and opportunities – essential steps toward a nature-positive economy. The recommendations and guidance will enable businesses and finance to integrate nature into decision making. Its aim is to support a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes, aligned with the Global Biodiversity Framework. The TNFD is market-led, science-based and government-endorsed, and consists of a number of institutions and groups that have worked together to create the recommendations and guidance.

The Green Finance Institute (GFI) hosts the TNFD Secretariat. Highlands Rewilding’s non-executive director, Helen Avery is Director of Nature Programmes and GFI Hive as her day job, overseeing the Institute's initiatives to mobilise private sector capital into nature-based solutions and nature restoration. I spoke to her about us and the TNFD.

Hannah: Hi Helen, please can you explain a bit more about the TNFD framework and what your team works to achieve in the UK?

Helen: Hi Hannah, yes! The framework is currently voluntary. In addition to hosting the global secretariat for the TNFD, the Green Finance Institute convenes the UK’s Consultation Group for the TNFD, which supports over 600 UK businesses in navigating the framework. Through our market engagement, we demonstrate how UK companies are implementing TNFD, build capacity on nature-related reporting and action across the UK market, and support companies to discuss nature and TNFD at Executive- and Board-level. We also work with adopters of the TNFD recommendations, such as Highlands Rewilding, to share learnings and best practices more widely.

Hannah: What do you think will be the benefits that Highlands Rewilding will realise through being a TNFD early adopter?

Helen: The TNFD framework provides an approach for businesses to systematically develop an understanding of key nature-related risks and opportunities relating to their activities. That may reveal new revenue models and also highlight key risks to profitability linked to nature degradation near or around landscapes. For Highlands Rewilding, going through the internal process that the framework offers will mean that you can speak the same language as many other businesses and financial institutions that are aligning with the TNFD – those businesses may be potential clients and partners. This will be particularly important for when Highlands Rewilding reports the positive impacts on nature across its activities. Forestry England, for example, are finding this to be the case already – that going through the process is very helpful in forming partnerships. You’ll hear them talk about this benefit in our most recent webinar.

Hannah: You know the Highlands Rewilding business very well. What might we find difficult in terms of disclosures we need to make?

Helen: TNFD adoption has been intentionally made easy to encourage organisations to start with the framework, and no business should feel they need to make all disclosures in the first round. Instead, we recommend focusing on the disclosures that will be strategically useful to Highlands Rewilding. For example, what question or questions would be helpful for you to have an answer to in the next year? What type of information will be useful when having conversations with funders and buyers?

Don’t fall into the trap of reporting for reporting’s sake – if there isn’t a material reason for adding information, then don’t spend time collating and reporting that information. You want the framework to help you identify risks and opportunities to start with.

Finally, we advise - start with what you already have. So, for example, take your natural capital report as a starting point and frame that content within the TNFD framework - again, this will help in speaking with corporates.

Hannah: The uptake of TNFD is far greater in nations such as Japan, where Jeremy was awarded the Blue Planet Prize in 2025. Why is this?

Helen: Well, there are a lot of potential reasons. Is it cultural? Is it because the central bank was so supportive of TCFD that people think TNFD will receive the same support? Is it because Japan’s largest pension fund pushed for sustainability – including nature? What we can say though is that the Japanese government has done much to support uptake from the TNFD. For example, the Japanese Ministry for Environment (MoE), released ‘Transitions Strategies towards a Nature Positive Economy’ in 2024. Within that set of Strategies it promotes nature-related financial disclosures based on TNFD and other reporting initiatives as one of its action plans.

Japan’s MoE has also done a lot to support financial institutions in working through the framework. For example, it implemented a pilot program for financial institutions on analysis of nature-related information which resulted in the publication of guidance for financial institutions that aligned with the TNFD recommendations.

Six years ago, the MoE also set up an awards scheme called ‘ESG Finance Award Japan’, and in 2024 added a Nature Positive Award for financial institutions, and then last year added the same award for the corporate sector. Prior to GFI, I was in journalism where we ran many sustainability awards and I’ve seen firsthand that the power of awards should never be underestimated when it comes to influencing behaviours!

Hannah: How will organisations reporting in line with TNFD transition from disclosure to investment in nature, and do you think that could be an opportunity for Highlands Rewilding?

Helen: The theory of change has always been that when businesses carry out their LEAP assessment – the core of the TNFD framework - then they will identify where they need to make investments to reduce their risks, and where there may be opportunities to invest. We are seeing indications of this shift towards investment in some reports already - especially among those businesses that have had a few iterations of reports now and therefore want to establish progress against their targets and commitments, or to show they are addressing both risk and opportunities.

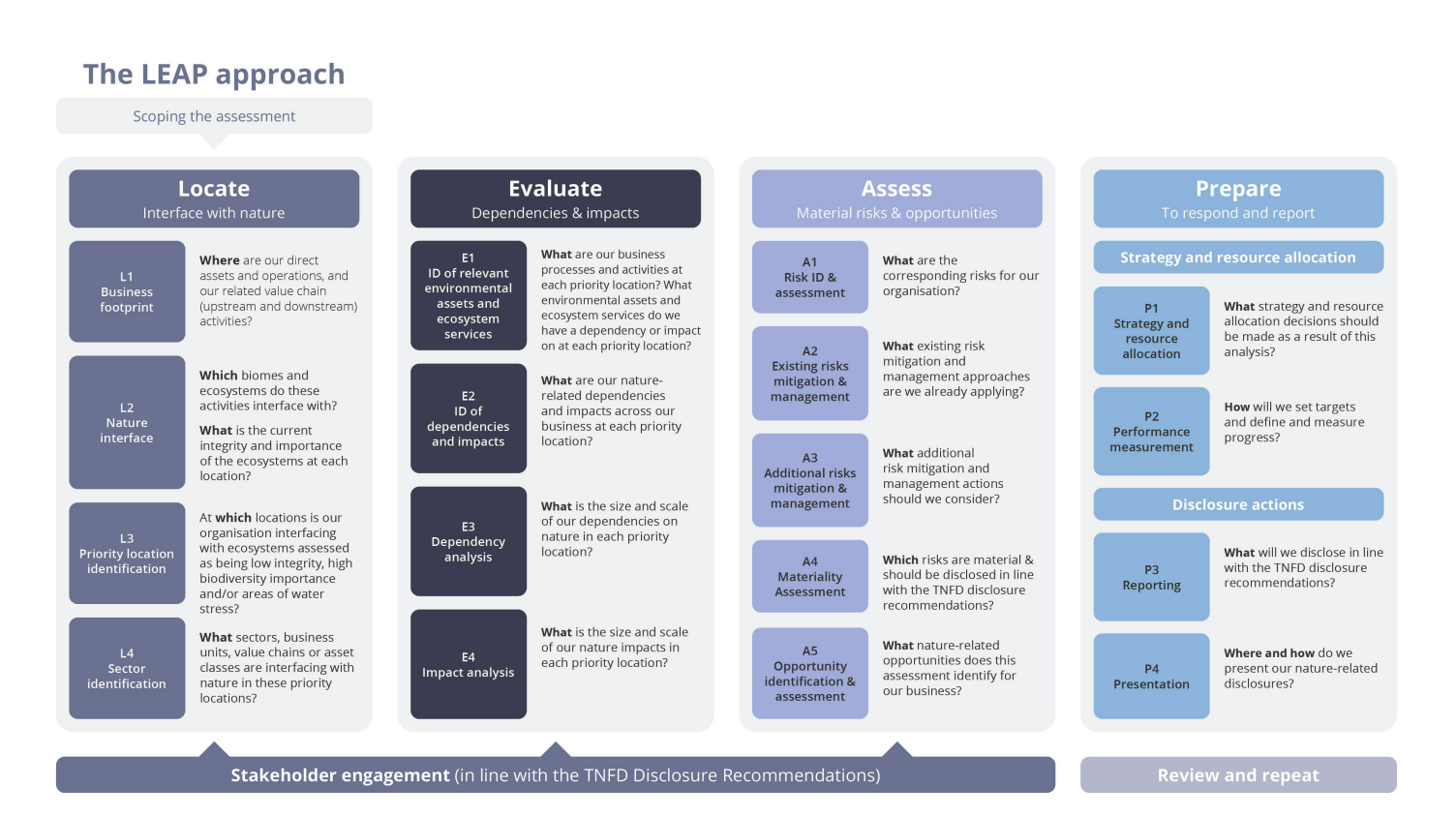

The TNFD’s LEAP approach - see PDF

That said, we know from climate disclosures that simply assessing risks does not lead to investment. At GFI in the UK we are trying to work with businesses in the UK Consultation Group to help understand what the barriers are to investing. For example, are businesses unclear how they can reduce their impact or help mitigate risks from their dependencies? Do they need support on understanding the solutions, including technology solutions, they would need? Do solutions exist? And if they do, do they make financial sense? – ie. do the benefits outweigh the costs?

Some sectors are further ahead than others – water utilities, for example, see a clear business case in ensuring they have sufficient water to operate, and that they are reducing negative impacts on water quality. Some of the agricultural businesses also are looking to invest to shore up their supply chains. Businesses in construction and housing are also moving forward at a relatively faster pace.

For businesses like Highlands Rewilding which deliver biodiversity uplift, and sustainable timber there are clear opportunities. There may, for example, be businesses that rely on the ecosystem services that Highlands Rewilding is providing in order to mitigate their own nature-related risks. There could also be growing demand for biodiversity-friendly timber products.

Separate to TNFD, down the line, we may also see compliance markets in Scotland - and potentially a growth in voluntary markets – that will lead to a demand for biodiversity credits. Clearly, when that happens Highlands Rewilding is in a good position given the amount of baselining and measurement of uplift that has been happening on its sites. Whether that market will be as big as many are hoping for, however, remains to be seen.

Many thanks to Helen for sharing these reflections and ideas – we’re excited to go on our own TNFD journey with a great and growing cohort of organisations taking responsibility for nature seriously.

TNFD Adopters around the world